Warren’s surveillance laws is tailored to assist large banks

[ad_1]

Plainly each time Massachusetts Senator Elizabeth Warren fails to get an anti-crypto invoice handed, she introduces a brand new draft. She has the technique of messaging payments — laws launched for the needs of media consideration and fundraising greater than precise passage — right down to a science.

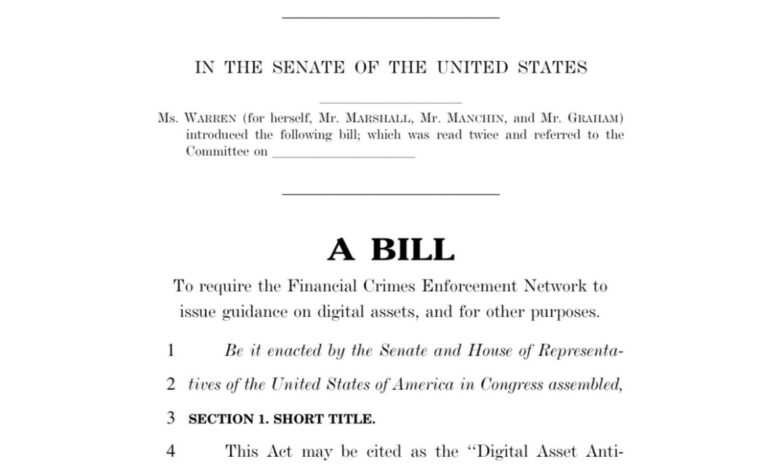

Warren’s newest laws, the Digital Asset Anti-Cash Laundering Act, threatens to undermine crypto’s core ideas of freedom and private sovereignty. Whereas Warren argues that her invoice is critical to fight illicit actions, a better look reveals its potential to stifle innovation, endanger person privateness, and play proper into the palms of huge banks.

The invoice, co-sponsored by Kansas Senator Roger Marshall, is predicated on a premise that digital belongings are more and more getting used for legal actions resembling cash laundering, ransomware assaults, and terrorist financing. Whereas some dangerous actors exploit digital belongings, the invoice’s method of treating all builders and pockets suppliers as potential criminals isn’t solely impractical but additionally harmful.

Associated: The SEC is dealing with one other defeat in its recycled lawsuit in opposition to Kraken

Probably the most harmful a part of the invoice is the requirement that digital asset builders adjust to Financial institution Secrecy Act (BSA) obligations and Know-Your-Buyer (KYC) necessities. This successfully locations the burden of regulation enforcement on the shoulders of software program builders. It is akin to requiring automotive producers to be answerable for how their automobiles are used on the street.

The invoice additional seeks to get rid of privateness instruments that shield crypto customers from malicious actors. By cracking down on digital asset mixers and anonymity-enhancing applied sciences, Warren’s proposal threatens the privateness rights of law-abiding residents. It is important to do not forget that privateness is a elementary proper, not a privilege that may be discarded at will. Numerous early Bitcoin (BTC) millionaires have been kidnapped and tortured as a direct results of the transparency of the Bitcoin blockchain, Warren would depart future Bitcoiners defenseless in opposition to such threats.

Whereas she claims to be performing within the title of nationwide safety, it is value noting that the massive banks would profit tremendously from limiting the competitors posed by cryptocurrencies. By imposing onerous laws, the invoice would make it tough for crypto to compete on a stage taking part in subject.

However what concerning the argument that digital belongings are being utilized by rogue nations and legal organizations? Whereas this can be a legitimate concern, it is essential to tell apart between the know-how itself and the actions of some. The identical argument might be utilized to money, which has been used for unlawful actions for hundreds of years. Banning money could be an overreaction, simply as overly restrictive crypto laws are.

Breaking: Elizabeth Warren’s newest proposed anti-crypto laws

Sen. Warren has co-sponsored the Digital Asset Anti-Cash Laundering Act of 2023.

Says the laws goals to:

-combat the “rising” misuse of digital belongings.

-close regulatory “gaps.”

-extends Financial institution… pic.twitter.com/cl0L95Fyaj— Carlo⚖️.eth (@DeFiDefenseLaw) December 11, 2023

One main concern is the invoice’s method to “unhosted” digital wallets, which permit people to bypass AML and sanctions checks. Whereas stopping illicit transactions is essential, the invoice’s proposed rule to require banks and cash service companies to confirm buyer identities and file experiences on sure transactions involving unhosted wallets could have unintended penalties.

Forcing people to supply private info for each transaction goes in opposition to the very ideas which have drawn folks to cryptocurrencies — privateness and pseudonymity. It is necessary to strike a stability between safety and particular person rights. Overregulation may drive customers away from regulated platforms, pushing them into unregulated, extra challenging-to-track environments.

Moreover, the invoice’s give attention to directing FinCEN to problem steerage on mitigating the dangers of dealing with anonymized digital belongings appears to misconceive the core tenets of blockchain know-how. Cryptocurrencies like Bitcoin are designed to be clear but pseudonymous. Making an attempt to get rid of this pseudonymity jeopardizes one of many key options that make blockchain safe and interesting to customers.

Associated: BRC-20 tokens are presenting new alternatives for Bitcoin consumers

One other important problem is the potential overreach in extending BSA guidelines to incorporate digital belongings. Requiring people engaged in transactions over $10,000 in digital belongings via offshore accounts to file a Report of International Financial institution and Monetary Accounts (FBAR) could also be extreme. It may end in pointless burdens on people who use digital belongings for professional functions, resembling cross-border remittances or investments.

Warren’s invoice is a sledgehammer method to a nuanced drawback. Relatively than stifling innovation and privateness, a extra balanced method could be to focus on particular legal actions and people. The present AML system, which massive crypto exchanges adjust to, has been efficient at interdicting illicit crypto utilization, which is why remoted cases have been reported.

The Digital Asset Anti-Cash Laundering Act is a deeply flawed piece of laws. Warren’s invoice poses an actual menace to the crypto neighborhood and dangers taking part in proper into the palms of huge banks. It is important that we discover a extra balanced and efficient resolution that addresses the issues with out stifling the potential of this transformative know-how.

J.W. Verret is an affiliate professor at George Mason College’s Antonin Scalia Regulation Faculty. He’s a working towards crypto forensic accountant and likewise practices securities regulation at Lawrence Regulation LLC. He’s a member of the Monetary Accounting Requirements Board’s Advisory Council and a former member of the SEC Investor Advisory Committee. He additionally leads the Crypto Freedom Lab, a suppose tank preventing for coverage change to protect freedom and privateness for crypto builders and customers.

This text is for normal info functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas and opinions expressed listed below are the writer’s alone and don’t essentially replicate or characterize the views and opinions of Cointelegraph.

[ad_2]

Source link