Thrive Capital doubles down on Clair, a fintech serving to frontline staff receives a commission immediately

[ad_1]

After creating a free earned-wage advance providing for frontline staff two years in the past, fintech firm Clair is again with a brand new software to assist staff receives a commission after finishing a shift and receiving $175 million in new fairness and debt funding.

Nico Simko, co-founder and CEO of Clair, informed Information World that the brand new funding consists of $25 million in fairness. It was led by Thrive Capital and consists of Upfront Ventures and Kairos. Clair’s whole venture-backed funds now rise to $45 million. As a part of the funding, Michael Presser, investing associate at Kairos, was appointed as a board observer.

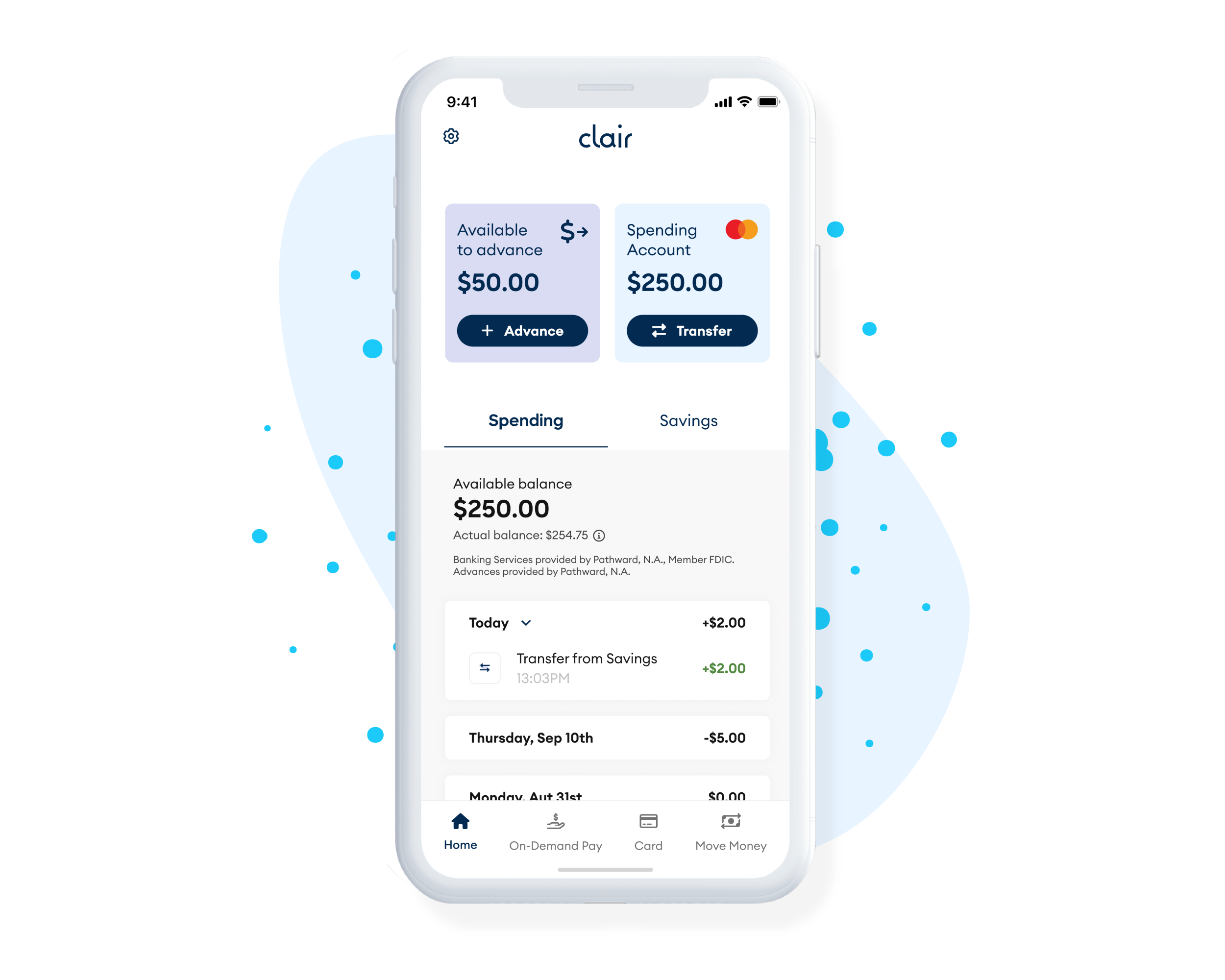

Clair frontline employee pay app. Picture Credit: Clair

The opposite $150 million is a part of a brand new shopper lending program from associate financial institution Pathward, which holds the FDIC-insured accounts for Clair and offers the wage advances to frontline staff.

Clair at present works with over 10,000 employers, workforce administration techniques and payroll and over 50,000 staff. Workers will see Clair by way of these present employer techniques that assist you to choose your schedule separate out of your payroll system. Employers can onboard workers and see payroll information. Workers can obtain the Clair app and conduct monetary actions, together with financial savings, verify printing and the power to withdraw funds at no cost by way of ATMs.

Simko touts the corporate’s new providing as “the primary free on-demand pay resolution” the place customers can withdraw funds instantly for the cash they’ve earned however not but obtained, immediately into their account.

“We’re the primary supplier that went to a financial institution and satisfied the financial institution to do these advances, principally as micro loans, $50 loans,” Simko stated. “Most early-stage, on-demand pay firms are those advancing the funds. By convincing a financial institution to do that, it offers regulatory certainty to our companions and customers as a result of there’s a nationwide financial institution backing it.”

He defined that having a financial institution make the advances “fueled our development, which included 10x income development over the previous 12 months,” and offered safety measures for employers nonetheless fascinated with the demise of Silicon Valley Financial institution and First Republic Financial institution.

Simko intends to deploy the brand new capital into assembly demand for Clair’s backlog of shoppers. And whereas it’s centered on workforce administration and payroll firms, the corporate has obtained some inbound requests from bigger companies that Simko goals to handle.

Clair can also be launching a lending program for employers referred to as Clair for Employers, which is a means for them to supply free, holistic monetary wellness advantages to their workers. The providing integrates with a firms’ payroll suppliers, and workers of firms utilizing it may additionally entry extra options of their Clair accounts, together with 3% money again on gasoline and groceries bought on their Clair Debit Mastercard.

As well as, the corporate is taking a look at different choices, together with a dynamic 401(okay) and well being financial savings account.

“With monetary companies tied to payroll and workforce administration, the sky’s the restrict,” Simko stated. “Most of those must be tied to a financial institution and payroll system, and since we’ve got these deep sorts of HR integrations, the imaginative and prescient of Clair is to construct the very best bang for America’s workforce.”

[ad_2]

Source link