Onchain leverage buying and selling platform Avantis Labs raises $4M seed spherical led by Pantera Capital

[ad_1]

Avantis Labs, a decentralized finance (DeFi) derivatives ecosystem, has raised $4 million in a seed funding spherical led by Pantera Capital, the corporate’s co-founder and CEO Sehaj Singh solely informed Information World.

Founders Fund, Coinbase’s Base Ecosystem Fund and Modular Capital additionally invested within the spherical. The capital will probably be used to develop its flagship product Avantis, a perpetual-trading and market-making protocol.

“We noticed a possibility to construct a protocol that caters to the complicated LPs,” Singh stated. “They’re not your run of the mill, common Joe; they’re very complicated, refined, on-chain, danger managing, yield-hunting people. The following huge step was to construct a protocol that caters to their particular person danger profiles.”

Perpetuals are a sort of by-product contract that permit merchants to invest on the value of an asset with out truly proudly owning it, that means that they don’t have an expiration date (like futures contracts) and will be held indefinitely.

Many DeFi perpetual protocols focus primarily on buying and selling cryptocurrencies, against conventional belongings like foreign exchange or commodities. Throughout the crypto neighborhood, there was an elevated demand in current months for extra actual world belongings (RWAs) to hyperlink the standard monetary market to the DeFi world and leveraged buying and selling.

However many RWAs which are out there on-chain by way of DeFi protocols are provided to accredited establishments, not on a regular basis merchants. Avantis plans to allow foreign exchange and commodities to “be hedged and traded on-chain” with out the necessity for tokenization, which is a gradual and costly course of, Singh stated.

“We take the leverage buying and selling mechanism [and] we not solely broaden it to real-world belongings, utilizing oracles, we additionally broaden out the LP aspect of issues by making it a bit extra complicated,” Singh stated. “We wish to name it the Uniswap V3 second for LPs of those leverage protocols.”

Avantis’ underlying buying and selling engine is powered by oracles from Pyth and Chainlink, that are low latency and intention to offer merchants with higher costs throughout centralized and decentralized monetary markets. The platform is being developed on Optimism Superchain, a community of chains constructed utilizing the OP Stack, and makes use of USDC stablecoins as collateral for trades on its protocol.

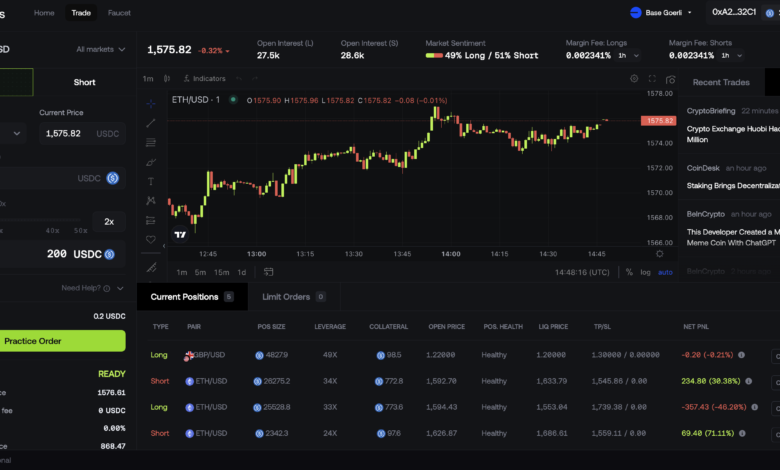

Avantis Buying and selling Terminal

Within the third quarter of this 12 months, Avantis launched its non-public testnet part on Base’s blockchain with preliminary choices of bitcoin and ether perpetual buying and selling. It plans to launch on Base’s mainnet by the primary quarter of 2024 and roll out common entry afterward.

Its waitlist has about 90,000 candidates, however it began onboarding about 2,500 individuals this previous weekend, Singh stated. It won’t be working within the U.S. or any OFAC sanctioned international locations until it could possibly get approval to function as an change below a CFTC license, he added.

The protocol goals to offer institutional and retail buyers the power to commerce crypto and RWAs with as much as 100x leverage on its decentralized change. It goals to offer these merchants and liquidity suppliers higher DeFi derivative-trading and market-making infrastructure in addition to “capital-efficient composability that’s scalable,” the corporate stated in a press release.

Composability is a typically “untapped” space by orderbook-based by-product protocols as a result of they’ve minimal buying and selling alternatives for non-crypto asset courses. Because of this, the DeFi house has been restricted to primarily crypto belongings.

On launching on the mainnet, Avantis will go reside with bitcoin and ether and three pairs for overseas change: the pound, JPY and the euro. Over time, it would add extra cryptocurrencies in addition to “unique foreign exchange pairs” like INR and USD, and commodities like gold, silver and crude oil, Singh stated.

“I actually do consider that it’s doable to offer entry to anybody to market-make these merchandise,” Singh stated. “These will not be as refined as individuals make them out to be. It’s simply that they’re very gated to market makers who’re within the conventional institutional world… With the intention to do it, it’s important to make a posh engine that folks can nonetheless perceive and that may perform properly at scale.”

It’s value noting that whereas this platform needs to cater to completely different buying and selling personas, it’s not for somebody who isn’t “crypto-native and who hasn’t purchased crypto of their life,” Singh stated. “It’s for individuals who have and perceive leverage buying and selling. Somebody who has an understanding of leverage is essential, [because] if you happen to don’t perceive it, you find yourself burning your self.”

In the long run, Avantis has an even bigger roadmap to broaden its protocols’ capabilities past perpetual buying and selling, and plans to start engaged on an choices engine by mid subsequent 12 months.

“The aim is to construct a complete ecosystem of margin-based merchandise which are totally on-chain,” Singh stated. “Choices [perpetuals trading] are the subsequent huge step for us.” Past that, the “subsequent frontier merchandise” for Avantis can vary from “on-chain casinos” to leverage vaults, he added.

[ad_2]

Source link