Oil costs regular amid OPEC+ lower doubts, Mid-East pressure By Reuters

[ad_1]

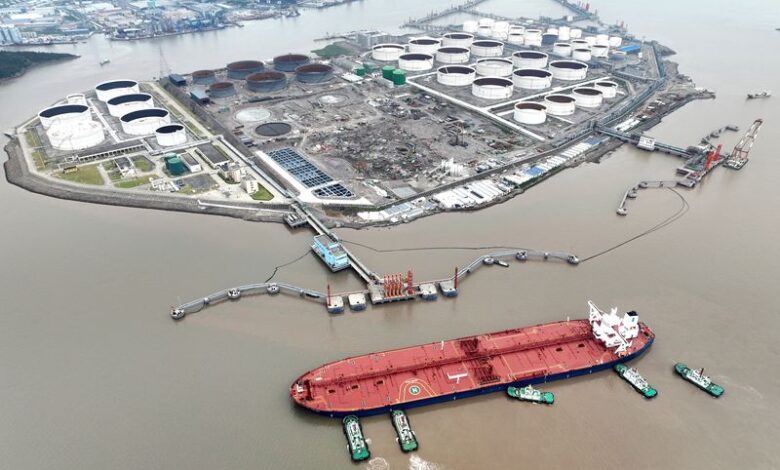

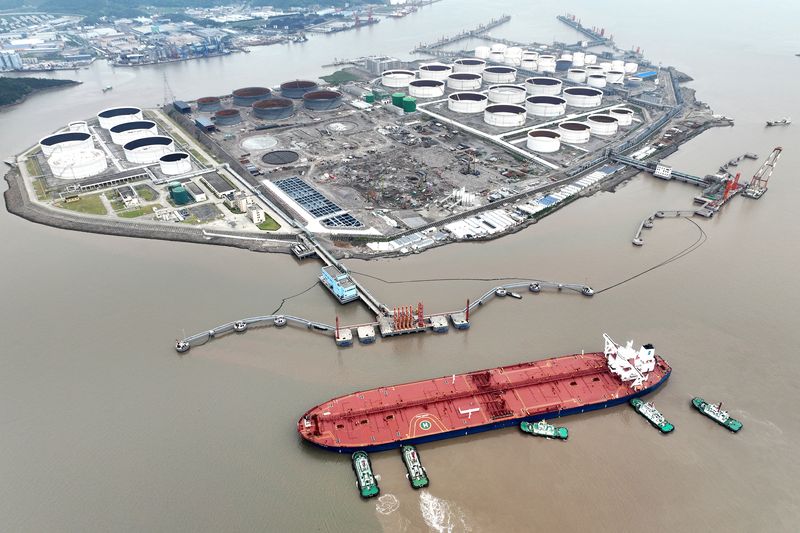

© Reuters. FILE PHOTO: An aerial view reveals tugboats serving to a crude oil tanker to berth at an oil terminal, off Waidiao Island in Zhoushan, Zhejiang province, China July 18, 2022. cnsphoto through REUTERS/File Picture

SINGAPORE (Reuters) – Oil costs held regular on Tuesday amid uncertainty over voluntary output cuts by OPEC+ and as continued pressure within the Center East spurred provide concern.

futures edged up 13 cents to $78.16 a barrel by 0106 GMT, whereas U.S. West Texas Intermediate crude futures had been up 18 cents at $73.22 a barrel.

Oil costs had declined within the earlier buying and selling session as merchants doubted that provide cuts by OPEC+ would have a major affect, and as a stronger U.S. greenback weighed on commodity costs usually, stated CMC Markets (LON:) analyst Tina Teng.

A stronger greenback usually makes oil costlier for holders of different currencies, which might dampen oil demand.

The Group of the Petroleum Exporting Nations (OPEC) and allies together with Russia, collectively referred to as OPEC+, on Thursday agreed to voluntary output cuts totalling about 2.2 million barrels per day (bpd) for the primary quarter of 2024, led by Saudi Arabia rolling over its present voluntary lower.

Not less than 1.3 million bpd of these cuts, nonetheless, had been an extension of voluntary curbs that Saudi Arabia and Russia already had in place.

Saudi Arabia’s vitality minister, Prince Abdulaziz bin Salman, informed Bloomberg in an interview on Monday that OPEC+ oil manufacturing cuts can “completely” proceed previous the primary quarter if wanted.

Resumption of preventing within the Israel-Hamas battle, nonetheless, stoked provide concern, as did assaults on three industrial vessels in worldwide waters within the southern Crimson Sea.

These incidents adopted a sequence of assaults in Center-Japanese waters since battle broke out between Israel and Palestinian militant group Hamas on Oct. 7.

[ad_2]

Source link