Mt. Gox reimbursement date looming: Is Bitcoin in bother?

[ad_1]

Whereas the cryptocurrency group is actively discussing the upcoming Bitcoin (BTC) halving in 2024, there’s doubtlessly one other large market occasion taking place this 12 months.

The trustee of the hacked Bitcoin trade Mt. Gox is about to lastly repay the trade’s collectors by the top of October 2023. If that occurs, the cryptocurrency market may very well be considerably affected in a number of methods, some business observers agree.

Based in 2010, Mt. Gox was as soon as the most important Bitcoin trade on the planet, estimated to facilitate round 70% of all BTC transactions earlier than its implosion.

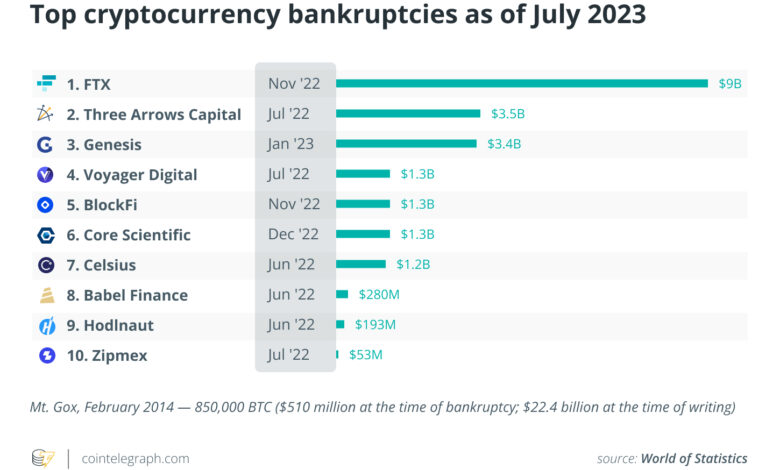

The now-defunct trade misplaced 850,000 BTC — or 4% of all Bitcoin to ever be issued — in a safety breach in 2014. The occasion made Mt. Gox one of many largest cryptocurrency bankruptcies of all time, with collectors but to be repaid, 9 years later.

As the present Mt. Gox reimbursement deadline is scheduled to happen in roughly three months, Cointelegraph has reached out to some crypto executives to search out out what to anticipate from the anticipated Mt. Gox reimbursement.

What’s going to the buyers do as soon as they get their Bitcoin again?

The reimbursement of Mt. Gox will probably be a singular occasion, which is for certain to have a big affect available on the market, WhaleWire founder and CEO Jacob King believes.

After shedding all their Bitcoin nearly 10 years in the past, nearly all of collectors are more likely to promote a minimum of part of their BTC as soon as they lastly get it again, King advised Cointelegraph.

“This inflow of promote orders might create a downward stress on costs and doubtlessly result in a market downturn,” he stated. King additionally talked about a number of extended delays within the Mt. Gox reimbursement course of, which has already brought about a way of “disillusionment amongst buyers, eroding their confidence out there.”

The WhaleWire CEO continued:

“It’s a easy query of, what’s going to the buyers do? During the last 12 months, we’ve seen extra sells than buys, and lots of of those that misplaced on Mt. Gox have moved on previous crypto. The probabilities they maintain for extra years, after all the pieces that occurred, is very unlikely.”

“We’re positive some will probably be glad to have the ability to lastly money out, however we doubt it can trigger a large dump,” he said. When requested whether or not the crypto business has ever seen the same occasion, Weert stated that there hasn’t ever been an occasion on such a scale to date.

Among the Mt. Gox collectors themselves admit that the Bitcoin market could face some promoting stress as soon as the reimbursement is completed. Nevertheless, many claimants are more likely to proceed to HODL, one dealer who described himself as a Mt. Gox creditor advised Cointelegraph. He said:

“Once we get our cash, I believe we’re all going to carry. However when the information hits the world that these cash are going to be launched, individuals who have cash however who are usually not the claimants, are going to promote for worry of the value happening.”

How a lot will probably be repaid?

Mt. Gox expects to repay a complete of greater than 10,000 crypto collectors from all around the world by the top of October. Regardless of the trade shedding 850,000 BTC, Mt. Gox will solely repay a part of the entire losses from the hack as a result of the agency was solely capable of get better a few of the funds.

In accordance with on-line studies, Mt. Gox will reimburse its collectors 142,000 BTC ($4.3 billion) and 143,000 in forked cryptocurrency Bitcoin Money (BCH), value roughly $40 million. The bankrupt trade may also reportedly pay out 69 million Japanese Yen ($510 million). Funds will probably be made utilizing a mix of fiat foreign money and cryptocurrencies, with every payout coordinated individually with every investor.

The reimbursement of Mt. Gox funds will probably be a large occasion, Whale Alert co-founder Frank Weert agrees. However the way in which it influences the market will rely a lot on how the funds are launched and the way the media report it, the exec advised Cointelegraph.

Some main collectors, together with Bitcoinica and MtGox Funding Funds, reportedly chose to have their chapter restoration funds paid out in Bitcoin.

In accordance with knowledge from the Mt. Gox steadiness bot on Twitter, the MtGox trustee holds 135,890 BTC on all identified addresses on the time of writing.

Complete present steadiness on all identified addresses* of the MtGox Trustee: 135890.98002134 BTC.

-0.00043187 BTC have been moved away from these addresses since 2018/05/10. $BTC #bitcoin #mtgox mt.gox mt gox

2023-07-11T09:19:03.239Z UTC

— MtGoxBalanceBot (@MtGoxBalanceBot) July 11, 2023

Mt. Gox Bitcoin reimbursement quantity is near Michael Saylor’s BTC holdings

Whereas many crypto fans imagine that Mt. Gox reimbursement will probably be a large occasion, there are additionally some skeptics who’re assured that any potential results are more likely to subside rapidly.

The quantity of Bitcoin that’s to be handed again to Mt. Gox collectors is similar to the holdings of Bitcoin advocate Michael Saylor, who holds a minimum of 152,333 BTC ($4.52 billion).

“Both method, it does not look like lots,” Quantum Economics founder Mati Greenspan advised Cointelegraph. Referring to the present value of Bitcoin that’s to be repaid, Greenspan emphasised that the present each day on-chain volumes are a lot larger.

Associated: $30B stolen from crypto ecosystem since 2012: Report

“Every day on-chain volumes are at a mean of $12 billion, trade volumes are reportedly within the neighborhood of $18 billion per day,” he famous, including:

“So that is definitely one thing the market can soak up in a comparatively brief time-frame. I’d assume there could also be some promote stress as a result of hypothesis round this occasion. Many individuals do not know primary math.”

Greenspan additionally burdened that Mt. Gox’s Bitcoin will probably be distributed to numerous folks, which may very well be superb for the community as a “mass-distribution occasion.”

“That is numerous OGs that will probably be reactivated. A few of them will promote and wash their palms however I guess many will probably be staunch advocates of self custody,” he added.

The exec additionally expressed optimism in regards to the potential reimbursement, stating that Mt. Gox-related FUD has been “plaguing the market” for a few years and will probably be “good to see it lastly put to mattress.”

Journal: Must you ‘orange capsule’ kids? The case for Bitcoin youngsters books

[ad_2]

Source link