Memecoins are like Powerball for crypto followers: Matrixport exec

[ad_1]

Memecoin consumers are enjoying the crypto-equivalent of Powerball — with many “enjoying” hoping for “life-changing cash” but only some will stroll away with the jackpot, says Matrixport’s head of analysis.

Memecoins have seen an enormous resurgence over the past week. Crypto tokens akin to Pepe (PEPE) and Milady (LADYS) have boasted staggering value surges regardless of every having little to no discernable utility.

Talking to Cointelegraph on Could 10, Matrixport’s Markus Thielen advised some consumers of memecoins bear resemblance to people who take part within the lottery.

“There are quite a few research completed on how most individuals in decrease socio-economic courses play the lottery […] as that’s their strategy to get out of their decrease financial class,” he stated, including:

“The folks that speculate within the lottery are attempting to make cash lightning quick, and I believe that is very comparable with crypto.”

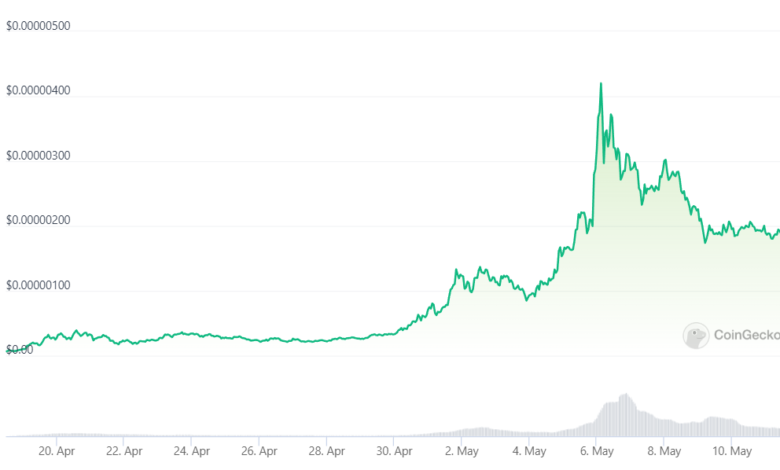

One memecoin that lately gained the eye of lovers is PEPE, a cryptocurrency cashing in on the “Pepe the frog” meme. It launched on April 14 and hit its peak $1.83 billion market cap solely weeks in a while Could 5.

The worth of the token plummeted nearly as shortly because it rose nevertheless, falling 57% from its peak in simply 5 days, according to CoinGecko, which places its market cap now effectively under a billion {dollars}.

One shouldn’t low cost the “leisure” issue of shopping for memecoins nevertheless.

Dr. Anastasia Hronis, a scientific psychologist who focuses on playing dependancy believes youthful buyers are extra doubtless pushed by the “enjoyable, leisure factor” of memecoins.

“Many crypto buyers would possibly purchase memecoins to be part of a group or for leisure worth.”

Nonetheless, for the numerous hoping to achieve from their investments, Hronis cautioned:

“Memecoins like PEPE could be enjoyable, however they typically are extremely dangerous investments and might find yourself holding no intrinsic worth in the long term […] Traders are primarily playing on its reputation, which undermines the rules concerned in investing.”

In an emailed assertion, Lucas Kiely, Chief Funding Officer at digital wealth platform Yield App argued that in contrast to Bitcoin (BTC), Ether (ETH) and stablecoins, memecoins don’t have the identical fundamentals. Their costs are pushed solely by “arbitrary elements” akin to group sentiment and are “nearly unimaginable to foretell.”

“Even probably the most subtle fashions have been unable to discern any clear patterns,” stated Kiely.

Professionals and whales nonetheless get FOMO too

The unpredictability of memecoins doesn’t imply there is not a possibility for outsized returns. Skilled buyers and “crypto whales” have been, and can proceed to take part in buying and selling them.

In keeping with information from blockchain analytics agency Lookonchain, “Machi Large Brother,” the net persona of former tech entrepreneur Jeffrey Huang bought a complete of 73.4 ETH — equal to roughly $137,000 — of Pepe prior to now 4 days.

Associated: Coinbase calls PEPE a ‘hate image,’ prompting calls to boycott the alternate

Three different whales additionally began to purchase PEPE on Could 9 after costs dropped.

3 whales began to purchase $PEPE after the worth dropped.

0x50C1 withdrew 1.4T $PEPE($2.76M) from #Binance when the worth was $0.000002054.

0x2Baa purchased 212B $PEPE($429K) with 223 $ETH($412K) at $0.000001942.

0x3AE8 purchased 424B $PEPE($864K) with 450 $ETH($831K) at $0.000001957. pic.twitter.com/Y3wFOshkDI

— Lookonchain (@lookonchain) May 9, 2023

“When the costs are large, it will probably make sense,” stated Thielen. “If it out of the blue makes a whole lot of information and a whole lot of tales, then I believe these folks should be invested as effectively.”

Thielen nevertheless cautioned buyers of memecoins akin to PEPE the place the event staff is nameless and there’s no discernable roadmap.

“The duty is to be forward of others and get out as soon as the momentum is popping. Because of this it is very important work with cease loss and stops when buying and selling dangerous belongings,” he advised.

“All people desires to dunk (promote) on somebody in memecoin land […] The query is simply who’s then holding the bag?”

Journal: Cryptocurrency buying and selling dependancy — What to look out for and the way it’s handled

[ad_2]

Source link