Man Utd takeover: Sir Jim Ratcliffe considers shopping for minority stake in Manchester United | Soccer Information

[ad_1]

Sir Jim Ratcliffe, the petrochemicals billionaire, is considering shopping for a minority stake in Manchester United Soccer Membership moderately than looking for full management, in an effort to finish an almost 10 month-long course of to resolve the membership’s future possession.

Sky Information has learnt that Sir Jim’s Ineos Sports activities car has proposed to the controlling Glazer household a deal that might see it buying chunks of each their shares and the inventory publicly traded on the New York Inventory Trade in equal proportion.

That provide would entail making a suggestion on the similar worth for each units of shares, with one suggestion on Monday night being that Sir Jim may search a roughly 25 per cent stake within the Pink Devils as a part of his newest proposal.

It might must be pitched at a valuation that the Glazers would settle for, implying that Ineos Sports activities may spend within the area of £1.5bn if it was to amass 1 / 4 of United’s shares – based mostly on earlier experiences that they had been looking for a minimal valuation of £6bn.

If such a deal was to be carried out, nevertheless, the Glazers would virtually definitely stay in management at Previous Trafford, having taken management of the membership in 2005.

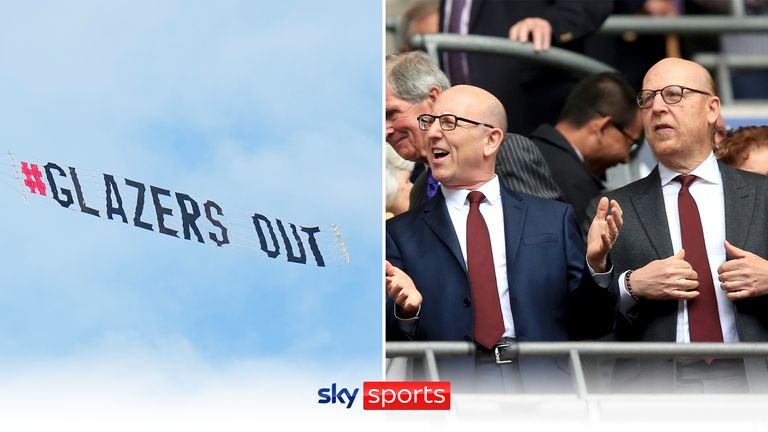

That might anger United supporters who’ve been vocal of their opposition to the household’s continued possession, and would in flip increase a collection of additional questions concerning the membership’s future.

On the pitch, the lads’s workforce have had an detached begin to the 2023/24 marketing campaign, being crushed at residence by Crystal Palace within the Premier League final weekend, and shedding their first Champions League fixture of the season.

One uncertainty on Monday night associated to the extent to which the Glazers and their advisers at Raine Group had been engaged with Sir Jim on his minority stake proposal.

The household, who paid just below £800m in 2005, has remained inscrutable all through the method and has mentioned nothing of substance to the NYSE for the reason that means of participating with potential consumers kicked off final November.

One other can be whether or not a suggestion to deliver Sir Jim in as a serious shareholder would increase any new capital to spend money on the membership, which is working in direction of a serious renovation of Previous Trafford.

The construction of a suggestion to amass a minority stake can also be unclear, with one analyst suggesting that it may very well be undertaken via a course of referred to as a young supply.

Bloomberg Information reported final week that Ineos was seeking to restructure its bid with out specifying particulars of how this might be achieved.

Some holders of the publicly-traded inventory – known as A shares – have raised considerations about Sir Jim’s earlier proposals, which targeted on buying a majority stake within the membership by shopping for shares from the six Glazer siblings who personal the category of B shares which carry disproportionate voting rights.

One other uncertainty would centre on whether or not a minority deal, if agreed and carried out, would give Ineos Sports activities an eventual path to full management of Manchester United.

Sky Information revealed in Might that its supply on the time included put-and-call preparations that might turn out to be exercisable three years after a takeover to allow Sir Jim to amass the rest of the membership’s shares.

The Monaco-based billionaire, who owns the Ligue 1 aspect Good, had been targeted on gaining management of Manchester United, which means that switching his supply to a minority deal would characterize a big shift.

He’s nonetheless understood to need to purchase a majority stake however has pitched a restructured deal in an try to unblock the continued deadlock over United’s future.

An Ineos spokesperson declined to touch upon Monday, citing the phrases of the non-disclosure settlement the bidders had signed as a part of the method.

For months, Ineos has been pitched in a two-way battle for management of Manchester United in opposition to Sheikh Jassim bin Hamad al-Thani, a Qatari businessman who chairs the Gulf state’s Qatar Islamic Financial institution.

Sheikh Jassim’s bid is reported to stay on the desk, and the convoluted nature of the strategic evaluation initiated by the Glazers late final yr signifies that a revised proposal from the Center East can not fully be dominated out.

The membership’s government co-chairs, Avram and Joel Glazer, have been reported throughout the course of the method to be extra reluctant to promote than their siblings.

Along with the competing bids from Sir Jim and Sheikh Jassim, the Glazers acquired a number of credible gives for minority stakes or financing to fund funding within the membership.

These embody a suggestion from the large American monetary investor Carlyle; Elliott Administration, the American hedge fund which till lately owned AC Milan; Ares Administration Company, a US-based different funding group; and Sixth Avenue, which lately purchased a 25 per cent stake within the long-term LaLiga broadcasting rights to FC Barcelona.

These had been designed to offer capital to overtake United’s ageing bodily infrastructure.

A part of the Glazers’ justification for attaching such an enormous valuation to the membership resides in the potential of it gaining higher management in way forward for its profitable broadcast rights, alongside a perception that arguably the world’s most well-known sports activities model might be commercially exploited extra successfully.

United’s New York-listed shares have gyrated wildly in current months as experiences have recommended that both a deal is shut or that the Glazers had been about to formally cancel the sale course of.

On Monday, they had been buying and selling at round $19.43, giving the membership a market valuation of $3.25bn.

Earlier this yr, Manchester United’s largest followers’ group, the Manchester United Supporters Belief, known as for the conclusion of the public sale “with out additional delay”.

The Glazers’ tenure has been dogged by controversy and protests, with the dearth of a Premier League title since Sir Alex Ferguson’s retirement as supervisor in 2013 fuelling followers’ anger on the debt-fuelled nature of their takeover.

Fury at their participation within the ill-fated European Tremendous League crystallised supporters’ want for brand spanking new house owners to switch the Glazers.

Confirming the launch of the strategic evaluation in November, Avram and Joel Glazer mentioned: “The power of Manchester United rests on the eagerness and loyalty of our world neighborhood of 1.1bn followers and followers.

“We’ll consider all choices to make sure that we greatest serve our followers and that Manchester United maximises the numerous development alternatives obtainable to the membership at the moment and sooner or later.”

The Glazers listed a minority stake within the firm in New York in 2012 however retained overwhelming management via a dual-class share construction which implies they maintain virtually all voting rights.

“Love United, Hate Glazers” has turn out to be a well-known chorus throughout their tenure, with supporters vital of a perceived lack of funding within the membership, even because the house owners have reaped massive dividends on account of its continued profitability.

A Manchester United spokesman declined to touch upon Monday.

[ad_2]

Source link