Japan Raises Curiosity Charges for First Time in 17 Years

[ad_1]

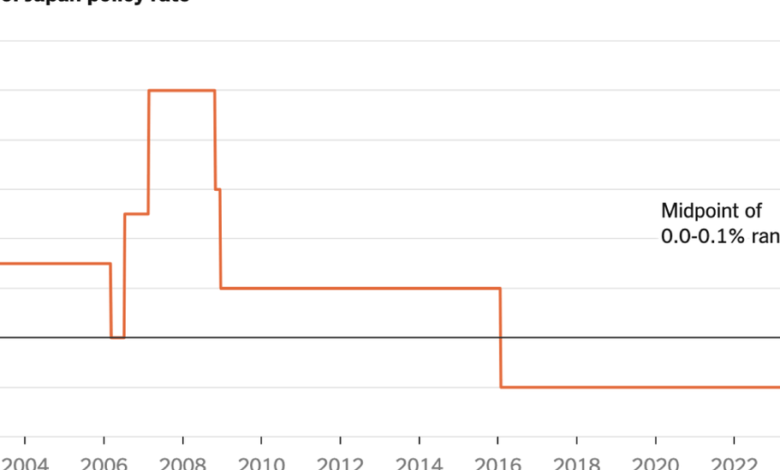

Japan’s central financial institution raised rates of interest for the primary time since 2007 on Tuesday, pushing them above zero to shut a chapter in its aggressive effort to stimulate an economic system that has lengthy struggled to develop.

In 2016, the Financial institution of Japan took the unorthodox step of bringing borrowing prices beneath zero, a bid to kick-start borrowing and lending and spur the nation’s stagnating economic system. Adverse rates of interest — which central banks in some European economies have additionally utilized — imply depositors pay to go away their cash with a financial institution, an incentive for them to spend it as an alternative.

However Japan’s economic system has not too long ago begun to point out indicators of stronger development: Inflation, after being low for years, has sped up, cemented by larger-than-usual will increase in wages. Each are clues that the economic system could also be on a course for extra sustained development, permitting the central financial institution to tighten its rate of interest coverage years after different main central banks raised charges quickly in response to a soar in inflation.

Even after Tuesday’s transfer, rates of interest in Japan are removed from these on the planet’s different main developed economies. The Financial institution of Japan’s goal coverage fee was raised to a variety of zero to 0.1 % from minus 0.1 %.

The financial institution, in a press release Tuesday, stated it had concluded that the economic system was in a “virtuous cycle” between wages and costs, which means that wages had been rising sufficient to cowl growing costs however not a lot as to chop into enterprise income. The primary inflation studying in Japan was 2.2 % in January, the newest knowledge out there.

The central financial institution additionally scrapped insurance policies during which it purchased Japanese authorities bonds, in addition to funds that spend money on actual property or observe shares, to maintain a lid on how excessive market charges can go, encouraging companies and households to borrow cheaply. The financial institution had been slowly stress-free the coverage over the previous 12 months, leading to increased yields on debt because the nation’s development prospects improved.

The financial institution stated that unfavourable rates of interest and the opposite steps it had taken to stimulate the economic system “have fulfilled their roles.”

In lots of international locations, a surge in inflation has tormented customers and policymakers, however in Japan, which extra usually grappled with growth-sapping deflation, the latest rise in costs has been welcomed by most economists. The Japanese inventory market, bolstered by bullishness within the economic system and company reforms that favor shareholders, has attracted huge sums of cash from traders around the globe, not too long ago serving to the Nikkei 225 index break a file excessive that had stood since 1989. The Nikkei rose 0.7 % on Tuesday.

The transfer away from unfavourable rates of interest, which ought to assist strengthen the nation’s weak forex, is seen by traders as one other essential step in Japan’s turnaround.

“It’s one other milestone within the normalization of financial coverage in Japan,” stated Arnout van Rijn, a portfolio supervisor at Robeco, who arrange and ran the Dutch fund supervisor’s Asia workplace for greater than a decade. “As a long-term Japan follower, that is very important.”

Bets on an increase in rates of interest had been boosted this month after the Japanese Commerce Union Confederation, the nation’s largest affiliation of labor unions, stated its seven million members would obtain wage will increase that averaged over 5 % this 12 months, the most important annual negotiated improve since 1991. That added to a median wage improve of round 3.6 % in 2023.

Earlier than the outcomes of the wage negotiations had been introduced, traders had anticipated the Financial institution of Japan to attend longer to lift rates of interest.

“This determination was based mostly on the arrogance that the Japanese economic system itself is altering, relatively than on short-term issues,” stated Shigeto Nagai, head of Japan economics at Oxford Economics.

Accelerating wage development is an important signal for policymakers that the economic system is powerful sufficient to generate some inflation and is ready to face up to increased rates of interest. Like different main central banks, the Financial institution of Japan goals for annual inflation of two %; the speed has been at or above that for practically two years.

The rise in wages alerts that corporations and employees anticipate increased costs to stay round, Mr. van Rijn stated. “Folks not consider costs will fall in order that percolates into wage calls for.”

The Financial institution of Japan, in its assertion, concluded that “it’s extremely seemingly that wages will proceed to extend steadily this 12 months, following the agency wage improve final 12 months.”

Shizuka Nakamura, 32, a resident of Yokohama, a port metropolis south of Tokyo, stated she had observed costs going up. “I do really feel the rising price of residing,” stated Ms. Nakamura, who works in an administrative job at a development firm. She not too long ago had a toddler.

“My buddies who’re across the identical age as me and who’ve additionally had kids all say that issues like diapers and child formulation are getting costlier,” she stated.

The Financial institution of Japan’s fee transfer was additionally important as a result of it was the final main central financial institution to exit its negative-rate coverage. It and central banks in Denmark, Sweden, Switzerland and the eurozone broke financial coverage taboos by pushing charges beneath zero — which primarily means depositors pay banks to carry their cash and collectors get much less again than they lend out — in an effort to ignite financial development after the 2008 monetary disaster. (Sweden ended negative rates in 2019, and the opposite European central banks adopted in 2022.)

Adverse central financial institution coverage charges upended world bond markets, with greater than $18 trillion of debt buying and selling at a unfavourable yield on the peak in 2020. As inflation and financial development has returned, and central banks have raised their coverage charges — most way more aggressively than Japan’s — hardly any debt now has a unfavourable yield.

Rising charges in Japan make investing within the nation comparatively extra rewarding for traders, however the Federal Reserve’s goal fee continues to be about 5 proportion factors increased and the European Central Financial institution’s is 4 factors increased. Whereas overseas traders have begun to funnel money into the nation, for Japanese traders the returns overseas are nonetheless engaging, even because the Fed and E.C.B. are anticipated to start reducing charges, stymieing a fast repatriation of money to Japan.

The Financial institution of Japan additionally steered it might make a gradual shift in coverage. Elevating charges too shortly might stamp out development earlier than it has taken maintain.

[ad_2]

Source link