Gold costs commerce sideways, CPI knowledge awaited for extra price cues By Investing.com

[ad_1]

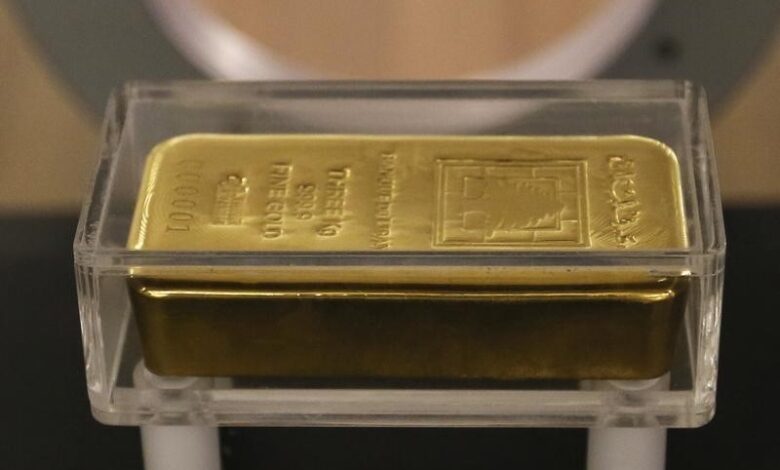

© Reuters.

Investing.com– Gold costs stored to a good vary on Tuesday, remaining underneath stress from the greenback as buyers hunkered down earlier than inflation knowledge that’s extensively anticipated to issue into the Federal Reserve’s plans for rates of interest.

The yellow steel had fallen again right into a $2,000 to $2,050 an oz commerce vary over the previous week, as merchants started steadily phasing out expectations of early rate of interest cuts by the Fed.

A slew of Fed audio system additionally warned final week that the financial institution was in no hurry to chop rates of interest early, amid fears of sticky inflation. This noticed the shoot as much as three-month highs, which weighed on gold.

The dollar edged larger in Asian commerce.

steadied at $2,020.06 an oz, whereas expiring in April had been flat at $2,033.45 an oz by 00:33 ET (05:33 GMT).

CPI knowledge awaited for extra Fed, price minimize cues

Information due afterward Tuesday is anticipated to indicate (CPI) inflation eased in January. However the studying can be anticipated to stay effectively above the Fed’s 2% annual goal, giving the central financial institution little trigger to start slicing rates of interest early.

This situation bodes poorly for gold, on condition that larger charges push up the chance value of shopping for bullion, which provides no yield.

Markets have been steadily pricing out expectations for price cuts in March and Could, and now see solely a forty five% likelihood of a 25 foundation level minimize in June, in line with the . Gold costs had tumbled amid the waning bets on early price cuts.

Spot costs had been now buying and selling simply $20 above the closely-watched $2,000 an oz assist degree, which analysts say could possibly be examined within the near-term, particularly within the wake of a stronger inflation studying.

Copper costs rebound, extra financial cues awaited

Amongst industrial metals, copper costs rose sharply from a three-month low after expectations of elevated supply- following the invention of an enormous copper deposit in Zambia- drove steep losses final week.

expiring in March rose 0.8% to $3.7485 a pound.

However the Zambia deposit will take years to become a completely operational mine, which signifies that the perceived provide bump in copper won’t materialize within the near-term.

On the demand entrance, focus was now on extra readings from main economies this week for extra clear cues on copper demand. Fourth quarter GDP knowledge from the , and is due later this week.

[ad_2]

Source link