Crypto financial institution run in 2022 catalyzed by institutional withdrawals: Analysis

[ad_1]

The 2022 crypto financial institution run induced by the failure of a number of giants within the ecosystem has a long-lasting affect on the crypto business. A brand new analysis report from the Federal Reserve Financial institution of Chicago (FRBC) has recognized a number of key elements and catalysts that accelerated the final yr’s crypto disaster.

The analysis report recognized that withdrawals by crypto whales and huge account holders on centralized exchanges together with a few of the key institutional accounts, created a liquidity disaster which ultimately led to the financial institution run.

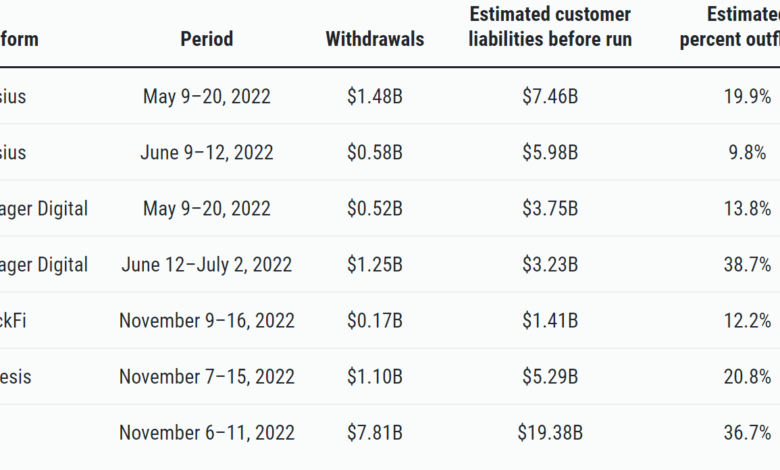

The primary disaster got here within the type of the TerraUSD collapse, which began the shopper outflow saga for a lot of crypto lenders with publicity to the Terra-Luna ecosystem. Celsius and Voyager Digital noticed outflows of 20% and 14% of their buyer funds, respectively, over 11 days after the information of the collapse surfaced. Celsius has additionally invested practically a billion {dollars} in Terra’s failed algorithmic stablecoin.

The second main disaster, catalyzed by excessive buyer outflows, got here within the type of Three Arrow Capital’s (3AC) downfall in July. Celsius and Voyager Digital noticed one other spherical of outflows of 10% and 39%, respectively, on account of their publicity to now-bankrupt 3AC.

3AC grew to become a significant supply of contagion within the crypto business as a number of corporations had lent billions in crypto belongings to the hedge fund, leading to a significant disaster after its downfall. Genesis supplied 3AC with loans totaling round $2.4 billion, BlockFi supplied $1 billion, Voyager Digital supplied $350 million and 15,250 bitcoins (value roughly $328 million in July 2022), and Celsius supplied round $75 million.

The third main disaster got here within the type of the FTX collapse in November. The crypto alternate itself noticed outflows of over 37% in buyer funds as information about its monetary instability grew to become public. Genesis and BlockFi prospects withdrew about 21% and 12% of their investments following FTX’s downfall.

Though most of those failed crypto platforms had a big retail buyer base, it was the subtle institutional shopper withdrawals that led to the key disaster. Earlier than June 9, 2022, a number of institutional shoppers have given Celsius a funding contribution of between $1.9 to $2.0 billion.

Associated: Coinbase establishes advisory council with former US lawmakers

Homeowners of large-sized accounts, outlined as these with investments totalling over $500,000, withdrew funds on the quickest charges and proportionately extra rapidly than different account holders. For instance, homeowners of accounts with greater than $1 million in investments made up 35% of all withdrawals at Celsius.

The analysis report noticed that though giant buyer withdrawals accelerated the disaster, crypto lending corporations providing excessive yields by way of dangerous investments had been the true offender. Not like banks, these lending platforms supplied no safety or insurance coverage towards such failures, and in consequence, prospects panicked in the course of the downturn available in the market.

Journal: Crypto regulation — Does SEC Chair Gary Gensler have the ultimate say?

[ad_2]

Source link