China securities regulator suspends restricted share lending from Monday By Reuters

[ad_1]

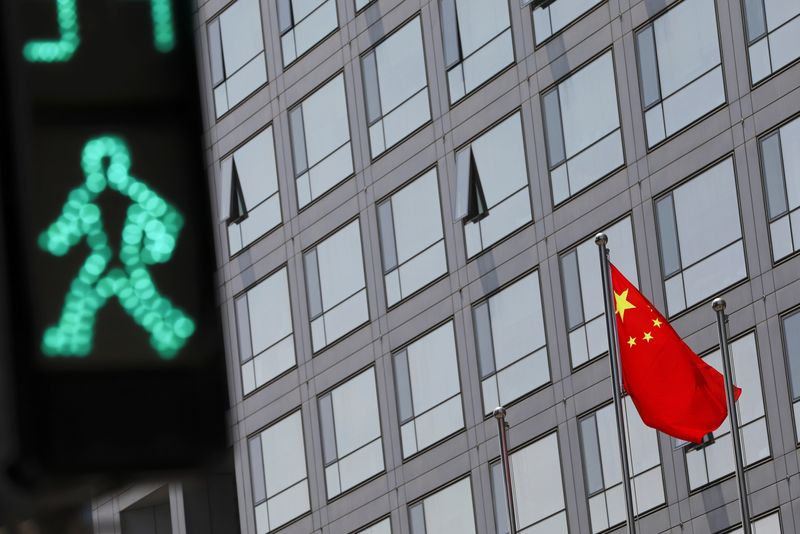

© Reuters. FILE PHOTO: A Chinese language nationwide flag flutters exterior the China Securities Regulatory Fee (CSRC) constructing on the Monetary Road in Beijing, China July 9, 2021. REUTERS/Tingshu Wang/File Photograph

2/2

SHANGHAI (Reuters) -China’s securities regulator mentioned on Sunday that it’ll totally droop the lending of restricted shares efficient from Monday, in policymakers’ newest try to stabilise the nation’s inventory markets following current sharp falls.

A string of supportive insurance policies by Beijing together with a deep reduce to financial institution reserves helped carry Chinese language shares off 5-year lows early final week however they retreated once more on Friday, reflecting deep investor pessimism over the outlook for markets and the shaky economic system.

Analysts and buyers say Beijing must roll out extra help measures to revive shopper and enterprise confidence and get exercise again on a extra strong footing.

Restricted shares are sometimes provided to firm workers or buyers with sure limits on their sale, however they are often lent to others for buying and selling functions, similar to short-selling, which might add strain on markets throughout a chronic droop.

Sunday’s transfer will “spotlight equity and reasonableness, scale back the effectivity of securities lending, and prohibit the benefits of establishments in using info and instruments, giving all sorts of buyers extra time to digest market info and making a fairer market order,” the China Securities Regulatory Fee (CSRC) mentioned an announcement revealed on its official WeChat account.

The CSRC added that the transfer would “resolutely” crack down on unlawful actions that use securities lending to cut back holdings and money out.

The regulator additionally mentioned it is going to restrict the effectivity of some securities lending within the securities refinancing market from March 18.

Final October, the CSRC restricted securities lending companies and tightened scrutiny of improper regulatory arbitrage by imposing increased margin necessities.

China’s inventory market tumbled in 2023 and has prolonged its slide within the new yr. Although the blue-chip CSI300 Index has recovered some floor, it nonetheless down about 3% year-to-date.

Small Chinese language buyers are scrambling even tougher than foreigners to exit the crumbling inventory markets, sending premiums on world index funds skyrocketing as they seek for publicity to something however the sputtering home economic system.

China’s economic system grew 5.2% for 2023, barely above the federal government’s goal, however the comparability was flattered by a weak, lockdown-hit 2022 and the restoration has been extremely uneven.

December knowledge confirmed lacklustre consumption and the quickest fall in residence costs for 9 years, with the property market in a deep disaster.

Each Shanghai and Shenzhen inventory exchanges mentioned they’ll droop securities lending by strategic buyers throughout lockup intervals, efficient from Jan. 29.

[ad_2]

Source link