Celsius provides practically 429K stETH to Lido’s lengthening withdrawal queue

[ad_1]

Bankrupt crypto lending agency Celsius is anxious to get its staked Ether (ETH) stash again from liquid staking platform Lido which enabled withdrawals this week.

Celsius initiated the method of withdrawing its Lido Staked ETH (stETH) from the protocol. In keeping with transaction data it has requested the withdrawal of 428,840 stETH in batches of 1,000.

The stash is valued at roughly $784.7 million at present costs. The transfer follows a transaction of an identical quantity of stETH on Might 15 in preparation for withdrawal.

As soon as the withdrawal course of is full, Celsius will obtain the equal in Ethereum and the stETH tokens shall be burnt by Lido.

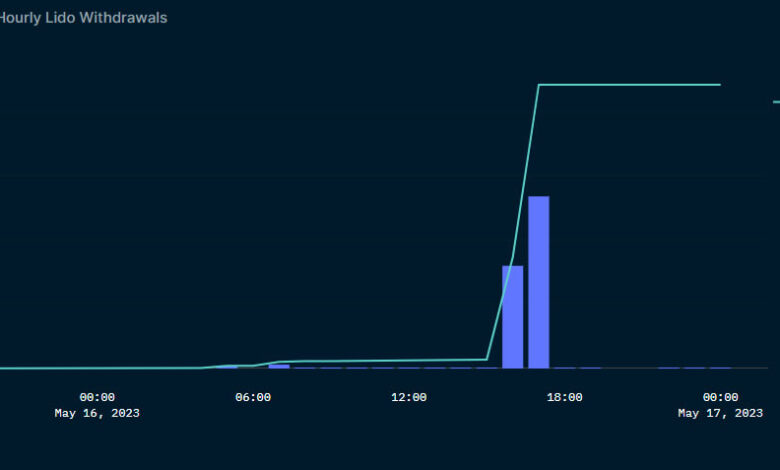

In keeping with Dune Analytics, the cumulative quantity of stETH within the withdrawal queue is 442,000 from 141 requests. It’s valued at round $808 million although Celsius is accountable for almost all of it. The entire quantity already processed is 629 ETH, based on Dune.

On Might 16, Lido acknowledged it had sufficient ETH in its buffers to soak up the requests.

At time of writing the Lido protocol has ≈440,000 ETH accessible within the protocol buffers.

There might be massive withdrawals this week. In that case, some shall be absorbed by this surplus.https://t.co/7MfbTuDAFxhttps://t.co/uOOBqsMv5C https://t.co/onrBa7bMhf

— Lido (@LidoFinance) May 16, 2023

Nonetheless, bigger numbers of Ether withdrawal requests from Lido will have an effect on the community withdrawal queue — which is a dynamic course of. Lido is the biggest staking supplier with a market share of just about 30% so Celsius might be in for an extended wait to get its ETH again if requests enhance.

Associated: 3 explanation why Lido DAO worth jumped 40% in every week

Analysis analyst at 21Shares, Tom Wan, suggested that if unstaking requests exceeded 10% it may trigger a bigger variety of validator exits. This is able to probably result in longer queues for withdrawals.

The capital could also be used as a part of Celsius restructuring efforts or to partially repay a few of its $4.7 billion money owed to collectors.

In late February, the crypto lender converted 22,962 wrapped Bitcoin (WBTC) into Bitcoin (BTC) in a transaction valued at roughly $540 million on the time.

Journal: Ordinals turned Bitcoin right into a worse model of Ethereum: Can we repair it?

[ad_2]

Source link