BlackRock ETF stirs US Bitcoin shopping for as analysis says ‘get off zero’

[ad_1]

Bitcoin (BTC) will suck in “all prosperity good points” in future and depart behind those that don’t have any publicity in consequence, a brand new prediction says.

In a Twitter thread on July 8, investor Luke Broyles delivered a daring imaginative and prescient of how Bitcoin would develop into “society’s base cash.”

Investor tells would-be Bitcoin consumers: “Get off zero”

What began off as a commentary on how synthetic intelligence (AI) is welcoming BTC quickly turned a dramatic define of the way it ought to find yourself because the world’s go-to foreign money.

For Broyles, Bitcoin’s key attribute — a set, immutable provide — makes it distinctive as a future-proof asset.

“Each innovation (even AI) will rush as rapidly as potential to competitively pressure costs down. Each nation will rush as rapidly as potential to print foreign money to pressure costs up and maintain credit score markets. Each of those forces will improve in pace,” he wrote.

BTC, in the meantime, will stay fixed in its emission, and in consequence, even a tiny publicity is a world away from nothing in any respect.

“We’ve got much less in widespread with the long run than the previous… Bitcoin is buying and selling for a whole lot of thousands and thousands of political foreign money models in many countries already. However the ACTUAL huge deal is that every one prosperity good points from all future improvements will circulation into society’s base money- BTC,” Broyles continued.

“This is the reason it’s CRUCIAL for folks to ‘get off zero.’ Saying ‘Bitcoin is digital gold’ is like saying a locomotive is an iron horse.”

His perspective chimes with that not too long ago revealed by Arthur Hayes, former CEO of crypto derivatives change, BitMEX.

As Cointelegraph reported, Hayes believes that AI will instinctively select BTC as its monetary lifeblood, once more because of its distinctive qualities in comparison with different belongings, together with gold.

Consequently, AI alone might push the BTC value previous $750,000 per token.

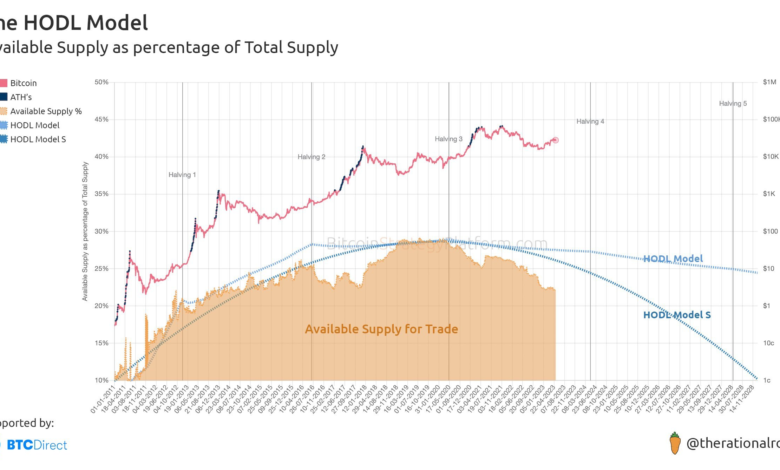

BTC provide dominance hits “inflection level”

The race to safe the remaining BTC provide, in the meantime, could have already began.

Associated: BTC value stays ‘undoubtedly bullish’ as $30K Bitcoin consumers emerge

Broyles argued that Bitcoin liquidity actually peaked throughout the March 2020 cross-market crash, and can by no means retrace its steps since.

When the world’s largest asset supervisor, BlackRock, introduced a Bitcoin spot-based exchange-traded fund (ETF) submitting, in the meantime, U.S. BTC exercise rocketed.

As famous by on-chain analytics agency Glassnode, the U.S. seems to be reassessing its personal publicity.

“Following the Blackrock Bitcoin ETF request announcement on June fifteenth, the share of Bitcoin provide held/traded by US entities has skilled a notable uptick, marking a possible inflection level in provide dominance if the development is sustained,” it commented on July 8.

An accompanying chart confirmed the variations in regional BTC provide possession change.

Journal: Do you have to ‘orange tablet’ kids? The case for Bitcoin children books

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.

[ad_2]

Source link