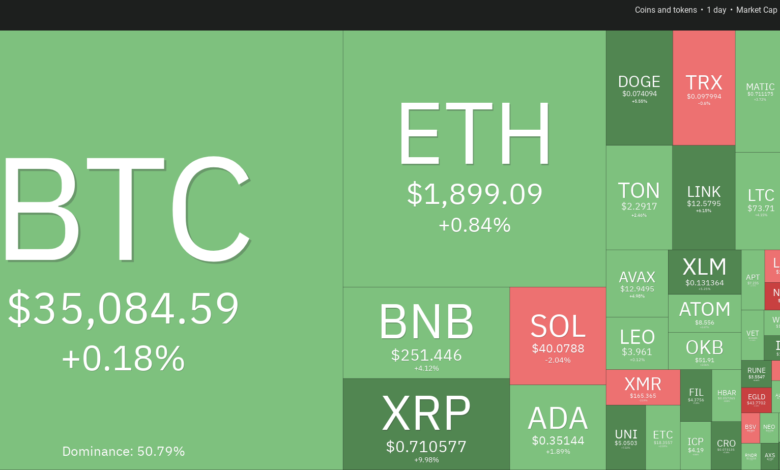

Bitcoin worth reclaims $35K — Will ATOM, UNI, NEAR and AXS rally subsequent?

[ad_1]

The S&P 500 Index soared 5.85% final week, its best efficiency since November 2022. A big a part of the beneficial properties had been fuelled by expectations that the Federal Reserve won’t hike charges anymore.

As compared, Bitcoin (BTC) had a a lot muted efficiency with an increase of roughly 2%. Nonetheless, a constructive signal for cryptocurrency buyers is {that a} threat on sentiment is more likely to profit the crypto house.

Bitcoin’s rise attracted investments in a number of beaten-down altcoins, that are rising from their long-term slumber. If Bitcoin doesn’t collapse, the restoration might unfold to cash which have nonetheless not participated within the rise.

At the same time as Bitcoin enters a spread, choose altcoins are displaying indicators of transferring larger. Let’s have a look at the charts of the top-5 cryptocurrencies which will prolong their rally within the subsequent few days.

Bitcoin worth evaluation

Bitcoin continues to commerce close to the $35,000 resistance and the value motion of the previous few days has fashioned an ascending channel sample. After a pointy rally, a decent ascending channel is mostly thought-about a destructive signal.

If the value turns down and skids beneath the channel, it could tempt a number of aggressive merchants to ebook income. Which will pull the value to the 20-day exponential transferring common ($33,033). A robust rebound off this stage will recommend that the bulls stay in command. They are going to then once more attempt to thrust the value above $36,000 and resume the uptrend.

Quite the opposite, if the value turns down and breaks beneath the 20-day EMA, the BTC/USDT pair might plunge to the sturdy assist zone between $32,400 and $31,000. The bulls are anticipated to defend this zone with all their would possibly as a result of a break beneath it’s going to tilt the benefit in favor of the bears.

The pair has been progressively rising contained in the ascending channel sample however the destructive divergence on the relative power index (RSI) means that the bullish momentum could also be weakening. If bulls wish to retain management, they must kick the value above the channel. In the event that they handle to do this, the pair might rally to $40,000.

In the meantime, the bears are more likely to produce other plans. They are going to attempt to sink the value beneath the channel and acquire the higher hand. If they’re profitable, the pair might tumble to $32,400.

Cosmos worth evaluation

Cosmos (ATOM) rose above the $7.60 resistance on Oct. 30, which accomplished a double backside sample. The bulls efficiently defended the breakout stage between Nov. 1-3.

Patrons propelled the value above $8.25 on Nov. 5, indicating the resumption of the uptrend. The sample goal from the breakout of the bullish setup is $8.91. This stage might act as a barrier but when crossed, the ATOM/USDT pair might run as much as $10.

The essential assist to look at on the draw back is $7.60. If bears pull the value beneath this stage, it’s going to recommend aggressive promoting at larger ranges. The pair might then dump to the 50-day SMA ($7.07).

The 4-hour chart reveals that the value rose above the close by resistance of $8.20, signaling a minor benefit to the patrons. If bulls preserve the value above $8.20, the pair is more likely to begin the following leg of the up-move to $8.91.

Contrarily, if the value turns down and breaks beneath the 20-EMA, it’s going to recommend that the markets have rejected the upper ranges. Which will result in lengthy liquidation and pull the value to the sturdy assist at $7.60.

Uniswap worth evaluation

Uniswap (UNI) reached the overhead resistance of $5 on Nov. 2 however the bulls couldn’t overcome the impediment.

A minor constructive in favor of the bulls is that they haven’t ceded floor to the bears. The transferring averages have accomplished a bullish crossover and the RSI is within the constructive zone, indicating that the bulls have the higher hand. If patrons propel the value above $5, the UNI/USDT pair might rise to $6 and thereafter to $6.40.

Opposite to this assumption, if the value turns down from $5, it’s going to recommend that the bears proceed to defend the extent with vigor. Which will pull the value right down to the 20-day EMA ($4.36), which stays the important thing stage for the bulls to defend in the event that they wish to preserve their benefit.

Patrons maintained the value above the 20-EMA however they may not overcome the roadblock at $5. This means that the bears haven’t given up and try to get again within the sport. A break and shut beneath the 20-EMA will additional strengthen the bears. The pair might then hunch to $4.50.

Then again, if the value turns up from the 20-EMA with pressure, it’s going to point out that the bulls proceed to purchase on dips. That will increase the chance of a break above the overhead resistance of $5. If that occurs, the pair might climb to $5.50.

Associated: Why is Cardano worth up immediately?

Close to Protocol worth evaluation

Close to Protocol (NEAR) has risen sharply up to now few days, indicating that the bulls try a comeback.

The bears mounted a stiff resistance at $1.63 however an encouraging signal was that the bulls didn’t permit the value to dip beneath $1.43. This implies that the patrons had been in no hurry to ebook income as they anticipated the rally to proceed.

If patrons maintain the value above $1.63, the NEAR/USDT pair might climb to $2. The chance to the up-move is the overbought ranges on the RSI. This implies a potential consolidation or correction within the close to time period. If the value slips beneath $1.63 the bears will once more attempt to shove the pair beneath $1.43.

After consolidating in a decent vary between $1.43 and $1.59 for a while, the bulls asserted their supremacy and pushed the value larger. The pair might first attain $1.78 and thereafter try a rally to $2.

The rising transferring averages point out benefit to patrons however the overbought ranges on the RSI recommend {that a} consolidation or correction is feasible within the brief time period. A drop beneath the 20-EMA would be the first signal that the bulls are shedding their grip. The pair might then drop to the 50-SMA.

Axie Infinity worth evaluation

Axie Infinity (AXS) has been in a robust restoration section for the previous a number of days however the bears haven’t given up and are promoting close to $6.

The bears tried to tug the value to the 20-day EMA ($5.11) however the bulls bought the dips beneath $5.40 as seen from the lengthy tail on the candlesticks. Patrons are attempting to renew the uptrend by pushing the value above $6. If they’ll pull it off, the AXS/USDT pair might begin the northward march to $6.55 and subsequently to $7.

If bulls wish to stop the uptrend, they must yank the value beneath the 20-day EMA. The pair then dangers a deeper correction to $4.65.

The pair broke above the symmetrical triangle sample on the 4-hour chart, indicating the resumption of the uptrend. The pair might rise to $6 the place the bears might once more mount a robust protection.

If the value turns down from this stage, the pair might drop to the 20-EMA. A robust bounce off this assist will enhance the prospects of a rally above $6. The pair might then bounce to $6.40. The bears can be again within the driver’s seat in the event that they pull the value beneath $5.17.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.

[ad_2]

Source link